Payday loans can be quite tough to know, especially if you have never taken a single out well before. However, obtaining a payday advance is less difficult for people who have removed online, done the right investigation and acquired just what these financial loans involve. Under, a long list of essential advice for payday loan clients is listed.

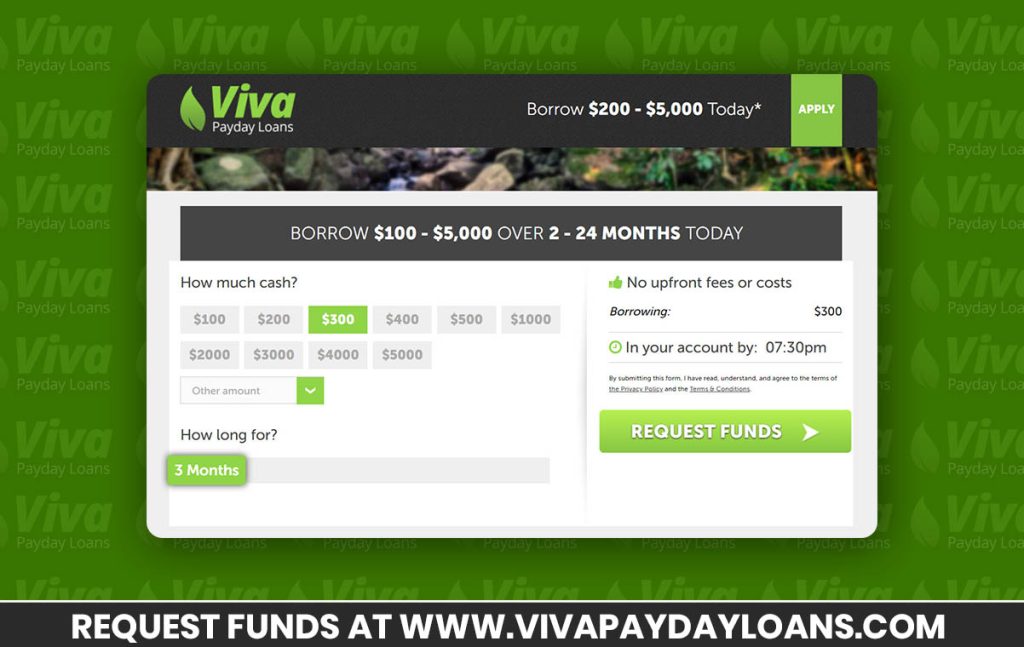

When identifying in case a payday advance suits you, you should know the amount most pay day loans will let you use is just not too much. Typically, as much as possible you will get from your payday advance is around $1,000. It can be even lower in case your revenue is not too much.

A greater option to a payday loans no credit check (psychonautica.org) loan is always to begin your own urgent savings account. Place in a bit dollars from each and every income until you have a great amount, including $500.00 roughly. Rather than building up the top-fascination charges a pay day loan can get, you might have your own pay day loan right at your financial institution. If you have to make use of the dollars, commence conserving again immediately in the event you require crisis cash in the foreseeable future.

There are some pay day loan companies that are fair on their consumers. Make time to investigate the company that you might want to adopt a loan by helping cover their prior to signing anything at all. Most of these businesses do not possess your best fascination with mind. You will need to consider yourself.

Look at all of the payday loan options before you choose a payday advance. While most creditors call for pay back in 14 time, there are a few loan companies who now provide a 30 day expression which may meet your requirements better. Diverse pay day loan loan companies may also provide diverse settlement possibilities, so find one that meets your needs.

If you're considering a payday advance, make sure to validate that you may have not one other alternatives. Online payday loans have extremely high rates of interest that can perhaps you have spending up to 25% of your respective original lone. Consider every other choices you could have before you apply for payday cash loans.

When you are thinking of agreeing to financing supply, make sure you can reimburse the total amount anytime soon. In case your preferred amount borrowed is higher than what you are able pay off in 3 weeks, you should consider other bank loan alternate options. There may be loan companies that are able to offer financing with lower prices plus a lengthier loan expression.

The very best tip accessible for making use of payday cash loans would be to never have to use them. In case you are battling with your bills and are not able to make finishes meet up with, payday loans are not the best way to get back in line. Attempt building a budget and preserving some funds so that you can stay away from these types of financial loans.

Before you sign a payday loan commitment, be sure that you completely comprehend the overall agreement. The small produce on these agreements usually shows hidden charges, including administration costs, that you just aren't mindful of until you seem. If you're not fully aware about what you're entering into, you could find oneself working with some serious trouble and debt.

In no way obtain a cash advance with respect to someone else, regardless how near your relationship is that you simply have with this person. When someone is unable to be eligible for a payday loan on their own, you must not trust them enough to put your credit score on the line.

In case you are self employed and seeking a pay day loan, worry not since they are continue to open to you. Because you probably won't have got a pay out stub to demonstrate evidence of career. Your best option is to bring a copy of the tax return as proof. Most creditors will nonetheless offer you a loan.

When getting a payday loan, it is essential that you seek information. You may not would like to blindly think an advertisement, since you will not be obtaining the whole tale. Speak with other people who have taken out this sort of loan, or study a few of the firm critiques online.

Give your friends and relations a telephone call and discover if they're in a position that will help you prior to taking out a payday advance. Unless you not get the dollars you want at first, get significantly less. This can save you lots of money in interest service fees if the amount you obtain is a lot less.

You need to understand that online payday loans ought to be employed sparingly. For those who have expenses that cant be paid by your paycheck, you may want to think about some sort of personal debt counseling.

As numerous many people have usually lamented, pay day loans certainly are a challenging factor to comprehend and can frequently result in folks plenty of issues whenever they discover how great the interests' monthly payments are. Nonetheless, you can manage your online payday loans utilizing the guidance and data supplied from the write-up earlier mentioned.